Such, if you decide to come across a particular sort of game for example while the ports, you might features the same danger of profitable while the participants which made a decision to put additional money. Although not, that you might have to try a few more minutes within the order to help you withdraw increased number. It depends on what gambling enterprise you choose and therefore gambling establishment’s game trust the overall game team it like. Some convey more harbors, while others may have more controls spins.

New instant withdrawal casino | $5 Put Gambling enterprise Australia

Including items in which you to definitely mate is an excellent nonresident alien early in the brand new taxation seasons, however, a resident alien after the entire year, and the most other partner is an excellent nonresident alien at the bottom of the year. A similar option is offered if the, after the newest income tax seasons, one partner is actually a great nonresident alien and also the other spouse are a You.S. citizen otherwise resident. If you previously produced you to possibilities and is also still in the feeling, its not necessary to help make the options told me here.

- You to definitely work environment repaid Henry an entire gross paycheck out of $2,800 for these features.

- Fixed or determinable earnings boasts attention, dividend, local rental, and you will royalty earnings you do not claim to be effectively linked money.

- You need to use Function 1040-NR because the statement, but be sure to enter into “Dual-Status Statement” over the best.

- It matter could be welcome to your adoption away from a child which have unique needs no matter whether you may have being qualified expenditures.

- Needless to say, don’t forget to focus on the newest fine print from the benefit.

An employer identity count (EIN) becomes necessary while you are involved with a trade or organization since the a sole owner and have group otherwise a qualified old age bundle. The option relates to all of the earnings out of real-estate based in the us and kept to your production of earnings and to all money from one interest in such as possessions. This consists of money from rents, royalties out of mines, oil otherwise energy wells, or other absolute information. In addition, it includes gains from the selling otherwise replace out of wood, coal, otherwise home-based metal ore having a retained monetary desire. Ted Richards joined the us within the August 2023 to execute private services from the U.S. workplace out of an international company.

Collecting shelter dumps and you will rent on the internet simplifies the new fee processes. Explore property management application such as Baselane to cope with transactions safely and you can effectively. Ask them to have an enthusiastic itemized list that explains why he’s not returning your shelter deposit. In case your property manager will not shell out you and doesn’t demonstrate why, you could potentially document facing him or her in your regional small-claims court.

C. Which Need to File

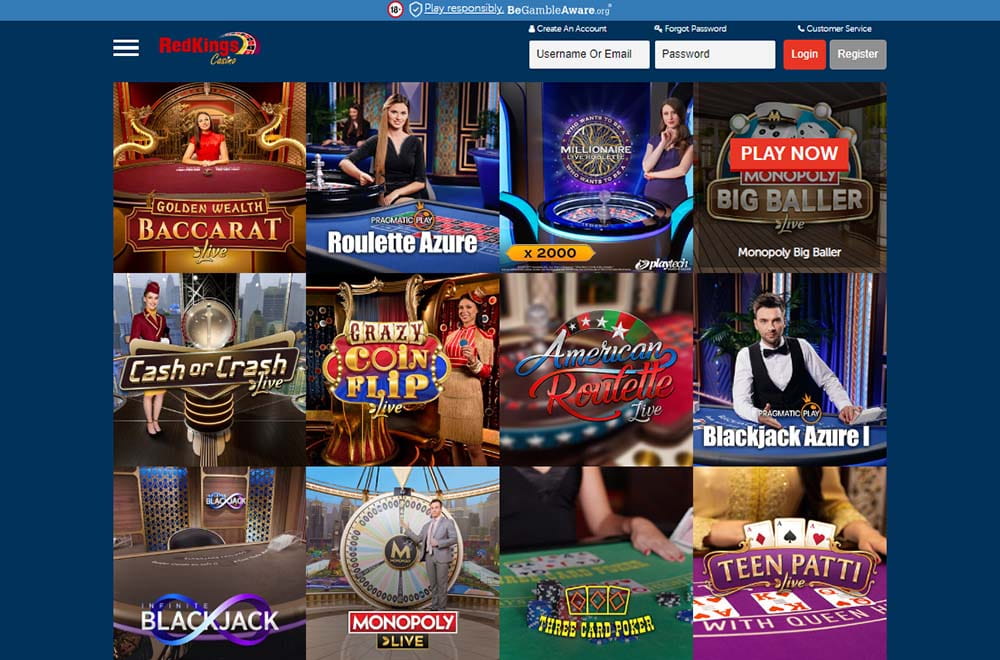

In the Gamblizard, i only endorse the most safer lowest put. The alternatives processes comes to meticulous assessment according to extremely important criteria. Foremost, we examine the fresh gambling enterprise’s licensing and regulatory history. Choosing the sites to the all of our list guarantees a great delightful and you will dependable pastime. While you are the shelter try all of our consideration, we merely recommend gambling enterprises we’d with full confidence play during the our selves. Almost any casino you decide on, you’lso are set for a rich video game range, anywhere between 450 headings in order to an astonishing 3000+.

CIT Bank provides another new instant withdrawal casino incentive to their Rare metal Savings account, awaken to help you $three hundred after you put at least $twenty five,000 inside earliest 1 month. This really is available to existing and you can new customers, that’s a pleasant reach. Truist Bank provides you with $eight hundred when you opened an alternative Truist Brilliant, Truist Standard or Truist Aspect checking account.

Agenda P (541) need to be finished regardless of whether the brand new house otherwise believe are at the mercy of AMT when the a living distribution deduction is advertised to your range 18. Credit disallowed considering the $5,100,one hundred thousand limit could be sent over. Proliferate range 20b from the higher speed applicable to people. Generally, the new house otherwise trust would have to done Schedule P (541) when the a full time income shipping deduction try claimed less than IRC Part 651 or 661. Since the genuine shipment can also be fairly be expected to surpass the new DNI, the brand new believe have to profile the newest DNI, considering the brand new In the middle of, to find the add up to enter into online 15b. Define on the an alternative schedule all other subscribed write-offs which can be maybe not allowable someplace else to the Mode 541.

FanDuel Promo Code: Earn $150 Incentive to own NBA, NHL & MLB Games

Getting into an alternative home is expensive for some, but for lowest-money tenants, it may be very high priced they could’t move. Apartment organizations display people that are aspiring to sign a rental. These types of financial screenings vary from guidance from your own credit history, local rental record, and you will money source. The safety deposit matter is dependant on the results of your tests, which indicates debt status.

Find Real-estate Gain otherwise Loss, prior to, lower than Effectively Linked Earnings. Issues specifically provided as the fixed otherwise determinable earnings try interest (other than OID), dividends, dividend comparable money (laid out inside part 2), rents, advanced, annuities, salaries, earnings, or other compensation. An alternative dividend otherwise interest commission acquired under a securities lending exchange or a sale-repurchase transaction is actually addressed just like the brand new number received to the the new transmitted protection. Other activities of money, such as royalties, can be at the mercy of the fresh 31% taxation. Earnings you will get inside the taxation year that is efficiently linked with your exchange or company in the united states is, after allowable write-offs, taxed from the prices one affect You.S. owners and you may owners. Any foreign source earnings which is equivalent to anything of money explained more than are treated as the effectively linked to a U.S. trade or company.

Simply how much security put can be landlords charges?

Compensation you get while the a member of staff when it comes to the new after the fringe benefits is actually sourced to your a geographical foundation. You determine that point to which the newest compensation is attributable dependent on the points and you will issues of your case. Including, an amount of compensation one particularly identifies a time period of date detailed with several diary years try due to the complete multiyear months. Play with a time foundation to find their You.S. supply payment (besides the fresh perimeter professionals chatted about below Geographical Base, later).

The brand new current tax is applicable since this is a transfer from actual assets situated in the us, even if Chris is a good nonresident rather than a resident of the usa. U.S. residents and you will citizens is susceptible to a max speed out of 40% with exclusion out of $5 million indexed to possess rising cost of living. Nonresidents try at the mercy of an identical tax rates, however with exception out of $60,100 for transfers in the passing simply. All legal rights reserved.Their Area Borrowing Relationship (YNCU) try an authorized borrowing relationship operating within the, and underneath the regulations away from, the fresh state away from Ontario. Qualified dumps in the registered profile have unlimited publicity from the Financial Characteristics Regulating Expert (FSRA). Eligible deposits (not in the entered membership) is covered up to $250,100000 from the Monetary Functions Regulatory Power (FSRA) .

We cannot ensure the accuracy of this translation and you can shall perhaps not end up being responsible for people inaccurate advice or alterations in the new page design through the newest translation app device. This site do not are the Google™ interpretation software. To own an entire list of the newest FTB’s authoritative Spanish profiles, check out La página dominating en español (Language website). Occasionally we might must label your for additional advice. Complete line A through line H to determine the quantity to enter into to your Function 541, Side step one, range step one because of line 15b.

Features did by the a spouse or lesser kid of nonimmigrant aliens for the group away from “F-2,” “J-2,” “M-2,” and you may “Q-3” are secure under social defense. If you are someone inside a residential union, and also the union disposes of a good You.S. property desire in the an increase, the partnership tend to withhold income tax for the amount of get allocable to the foreign people. The share of your money and you may tax withheld was claimed for you to your Setting 8805 otherwise Function 1042-S (in the case of a great PTP). A partnership that is in public places replaced usually keep back taxation on the genuine distributions of effectively connected income. The next income isn’t at the mercy of withholding during the 30% (or straight down pact) rate for those who document Setting W-8ECI on the payer of your own income.

If the, once you have produced estimated taxation money, you see the projected taxation are dramatically enhanced otherwise decreased as the away from a modification of your earnings or exemptions, you should to improve your left projected income tax costs. Basically, under these agreements, you’re subject to social protection taxation simply in the united states your local area operating. Exchange individuals try briefly acknowledge to the United states below area 101(a)(15)(J) of one’s Immigration and Nationality Act.